Current Program

Since announcing its first resource estimate on March 5th, 2018 the Company has continued intensive exploration efforts while also completing mineralogical, metallurgical and process test work, collecting baseline environmental data and conducting community relations work. This work was incorporated into an updated mineral resource estimate and Preliminary Economic Assessment (“PEA”) for Ivana, as announced on February 22nd, 2024.

Highlights of the PEA include:

PEA Highlights (All figures in US dollars)

- After-tax NPV 8%: $227.7 million

- After-tax IRR: 38.9%

- After-tax Payback period: 1.9 years

- Pre-production Capital Cost: $159.7 million, includes $35.4 million contingency

- Life of mine (“LOM”) Sustaining Capital Cost: $27.3 million, includes $5.4 million contingency

- Average LOM Total Cash Cost net of credits: $23.29/lb U3O8

- Average LOM All-In Sustaining Costs (“AISC”) net of credits: $24.95/lb U3O8

PEA Key Assumptions & Inputs

- Uranium price: $75/lb U3O8

- Vanadium Price $7.5/lb V2O5

- Years of Construction: 2

- Years of Production: 11

- Strip Ratio: 1.5:1 (waste/ore)

- Dilution: 3%

- Average Mining rate (waste + mill feed): 5.10 Mtpa

- Processing throughput: 2.17 Mtpa

- Process Plant Recoveries (Net), Uranium: 84.6%

- Process Plant Recoveries (Net), Vanadium: 52.5%

- Average Annual Production (LOM): 1.5 Mlbs/y U3O8

- LOM uranium production: 16.5 Mlbs U3O8

The PEA is preliminary in nature and is intended to provide an initial assessment of the project’s economic potential and development options. The PEA mine schedule and economic assessment includes numerous assumptions and is based on both Indicated and Inferred mineral resources. Inferred resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA results will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability. Additional exploration will be required to potentially upgrade the classification of the inferred mineral resources to be considered in future advanced studies.

Table 1. Mineral Resource Statement for the Ivana Deposit, Amarillo Grande Project, February 22, 2024. Davis & Lomas.

| Zone | Class | Tonnes (Mt) | Average Grade | Contained Metal | ||||

|---|---|---|---|---|---|---|---|---|

| U (ppm) | U308 (%) | V (ppm) | V2O5 (%) | U308 (Mlb) | V2O5 (Mlb) | |||

| Upper | Indicated | 2.0 | 122 | 0.014 | 110 | 0.020 | 0.6 | 0.9 |

| Lower | Indicated | 17.6 | 358 | 0.042 | 104 | 0.019 | 16.4 | 7.2 |

| Total | Indicated | 19.7 | 333 | 0.039 | 105 | 0.019 | 17.0 | 8.1 |

| Upper | Inferred | 1.4 | 167 | 0.020 | 170 | 0.030 | 0.6 | 0.9 |

| Lower | Inferred | 4.2 | 293 | 0.035 | 90 | 0.016 | 3.2 | 1.5 |

| Total | Inferred | 5.6 | 262 | 0.031 | 109 | 0.019 | 3.8 | 2.4 |

Notes to Table 1:

1. The effective date of the Mineral Resource is October 14, 2023. The QPs for the Mineral Resource estimate are Susan Lomas, P.Geo. of Lions Gate Geological Consulting (LGGC) and Dr. Bruce Davis FAusIMM.

2. CIM Definition Standards were used for Mineral Resource classification and in accordance with CIM MRMR Best Practice Guidelines. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

3. Extreme High-grade samples were capped to lower grades (Upper U 1000 ppm, V 400 ppm, Lower U 3000 ppm, V 1000 ppm) and then restricted using an outlier strategy where Upper composites were limited to U 400 ppm and V 300 ppm over 100 m and Lower composites were limited to U 2000 ppm and V 600 ppm over 100 m. Mineral grades were estimated into a 50x50x2 m block model using krige method.

4. Mineral Resources were tabulated within a resource limiting pitshell using $US 75/lb U price, recovery of 84.6% U; open pit mining cost of $1.50/t mineralization mined; processing and G&A cost of $6.30/t processed; pit slope of 32°. Bulk density value of 2.1 g/cm3was used for mineralized material.

5. The resource was estimated within distinct zones of elevated uranium concentration occurring within the host sediments. Vanadium is associated with uranium and is estimated within the same zones. There is no indication that Vanadium occurs outside of the elevated uranium zones in the Ivana deposit area in sufficient concentrations to justify developing estimation domains focused on Vanadium.

The reader is cautioned that Resources in the Inferred category have a lower level of confidence than that applying to Indicated resources and, although there is sufficient evidence to imply geologic grade and continuity, these characteristics cannot be verified based on the current data. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated mineral resources with continued exploration.

Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resource will be converted into a Mineral Reserve upon application of modifying factors. Additional exploration will be required to potentially upgrade the classification of the Inferred Mineral Resources to be considered in future advanced studies.

Additional exploration work and detailed engineering studies are expected to further optimize and enhance the economics of the Ivana uranium-vanadium deposit. Blue Sky is continuing exploration proximal to the Ivana deposit and throughout the Amarillo Grande project.

Location and Access

The Ivana group of tenures is situated north of Valcheta City in Rio Negro Province. It is the southernmost property along the 145 kilometre NW-SE trend that contains the Ivana deposit and a series of airborne radiometric anomalies which represent future exploration targets. The project has year-round access through a well-maintained gravel road network, in an area of very low population density. The project is in a semi-arid topographical depression, close to 100m below the elevation of Valcheta City, with low rainfall, and within a closed hydrologic system.

Discovery History

Ivana was the third discovery area in the district. In April, 2010, Blue Sky was granted a special airborne geophysics license covering 2.265 million hectares that included all of the prospective areas identified by the Company at the time for uranium in the Neuquen sedimentary basin of Rio Negro Province. The license allowed Blue Sky to fly high-resolution airborne radiometric and magnetic surveys. Blue Sky was given right to acquire new exploration licenses on the targets identified in the survey. The Ivana property was acquired to cover several of the anomalies identified by this survey.

A follow-up ground radiometric survey confirmed a >25 kilometre-long anomaly caused by uranium mineralization at or near surface. Field programs included prospecting, geological mapping, sampling/testing of hand pits, auger & shallow rotary drill holes, and a 2,023 metre diamond drill program comprised of 11 holes. Much of this work was funded through a joint venture with the French multi-national uranium company Areva (now called Orano).

Starting in 2017, field work at Ivana included three phases of reverse circulation (“RC”) drilling of 488 shallow holes totaling over 7,600 metres. Results from the three drilling programs were used in the current Mineral Resource Estimate.

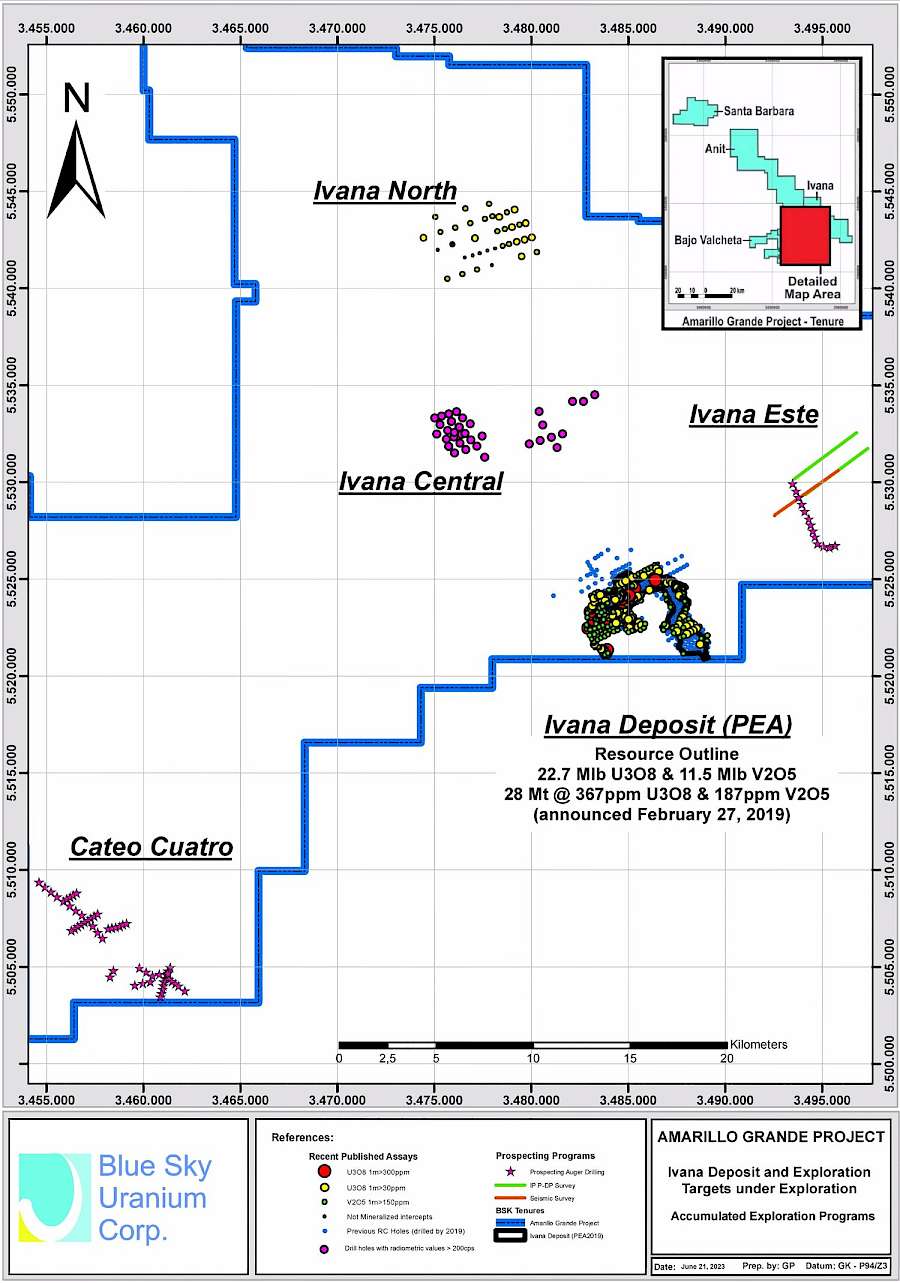

Work continues to expand the known mineralization within 20km of the Ivana deposit. Pit sampling, auger sampling, geophysics and drilling have been used to delineate multiple new targets to explore for additional resources, including Ivana West, Central, North and the most recently identified, Cuatro and Ivana East target areas.

Please refer to the most recent News Releases and Presentation for details of the on-going program.

Figure 1. Ivana Deposit and Targets

Geology & Mineralization

The Ivana prospect area is underlain by continental epiclastic and pyroclastic rocks of the Upper Oligocene-Middle Miocene Chichinales Formation that were deposited unconformably over the rocks of the North Patagonian Massif, or over a marine sequence of Arroyo Barbudo Formation and a red bed section of the Cretaceous Neuquén Group. The uranium-vanadium mineralized horizons are hosted mostly in medium to coarse poorly consolidated sandstones, minor conglomerates, and mudstones of the lower Chichinales Formation; in weathered basement in fractures and secondary porosity; and in the regolith debris at the basement unconformity.

Mineralization in the Ivana deposit is characterized by mineral assemblages representative of both oxide and primary endmembers, occurring together in varying proportions. Oxide mineralization is composed predominately of carnotite, with minor β-coffinite, liebigite, tyuyamunite and variable limonitic iron oxides coating pebbles and sand grains, and disseminated in fine-grained poorly-consolidated sedimentary rocks. Primary style mineralization is composed predominately by β-ccoffinite, with minor carnotite, tyuyamunite, liebigite and pyrite hosted within carbonaceous gray-colored poorly-consolidated sedimentary rocks. A variant of the primary mineralization is dark brown to black in color from impregnation by vitreous "non-woody" carbonaceous organic matter.

These two types of mineralization are associated with alteration assemblages that suggest at least two processes of uranium deposition were active at Ivana. The deposit has been described as being comprised of an upper and lower zone. The two zones occur together through most of the deposit but there are localized areas where only one zone is present. The upper zone averages 2.7 metres in thickness, with a maximum of 10 metres, while the lower zone has a maximum of 20 metres and has an average thickness of 6.2 metres. In the upper zone uranium oxide minerals are predominant while in the lower zone β-coffinite occurs in greater abundance than the oxide minerals.

Four alteration styles have been recognized at the Ivana Deposit; reduced alteration, reduced carbonaceous alteration, oxidized alteration and hematitic alteration. These alteration types appear to relate to an oxidation-reduction boundary with a complex geometry that is not yet completely understood, but appears to be a controlling factor in the deposition of the primary uranium-vanadium mineralization.

The Ivana uranium-vanadium deposit has some similarities to the surficial uranium deposits of Australia and Namibia in the oxide uranium vanadium mineralization, however, lacks the well-developed calcrete layers generally associated with surficial uranium deposits in semi-arid to arid climates. The primary uranium mineralization at Ivana has considerable similarities to sandstone-hosted uranium deposits, particularly basal-channel sandstone-hosted uranium deposits, and appears to be related to a redox boundary of possible regional extent. Therefore, the Ivana uranium-vanadium deposit should be considered a unique deposit, including characteristics of surficial and sandstone-hosted deposits. That model is maturing as exploration of the deposit progresses.

For a full description of the history, geology, mineralization and exploration programs, please refer to the NI 43-101 Technical Report.